Amazon will acquire the concierge medicine practice One Medical in an all-cash deal valued at $3.9 billion. The move is reminiscent of the e-commerce giant’s 2017 acquisition of Whole Foods, which helped Amazon rapidly scale up in a new market by acquiring a large brick-and-mortar presence in areas where it already had a sizable customer base. Amazon recently reorganized its health care operations under longtime exec Neil Lindsay, who had previously led the company’s Prime marketing team. Lindsay, now senior vice president of health services, reports to newly named CEO of Amazon Stores Doug Herrington. The deal values the public health care company One Medical at an eye-popping $18 per share, around double the average price the company’s stock traded at over the last six months. One Medical is a membership-based health care organization that operates over 70 boutique primary care offices around the country, typically in partnership with larger local health care providers like Mount Sinai. The company aimed to challenge the traditional health care model with its streamlined virtual care platform and bespoke app. Amazon has slowly been encroaching into the health care space since its now-shuttered joint venture with Berkshire Hathaway and JPMorgan in 2018, which aimed to revolutionize employee health care using technology to cut costs. Since then, it has acquired mail-order pharmacy PillPack and expanded its own primary care practice, Amazon Care, in partnership with Crossover Health. Understand the science behind hydrogen fuel cell vehicles, and how they differ from traditional EVs. |

|

|

From Nevada gold to Maine’s top-tier lobsters, here are America’s top exports by state using data from the U.S. Census Bureau. |

|

|

Petroleum is the top import in twelve states, making it the most commonly imported commodity across America. |

|

|

Smoldering temperatures are wreaking havoc across Europe. Here are 5 key things you should know about Europe's current heatwave. |

|

|

Population decline is a rising issue for many countries in Eastern Europe, as well as outliers like Japan and Cuba. |

|

|

The average American consumes more than 23 barrels of petroleum products annually. What does a lifetime of fossil fuel consumption look like? |

|

|

The gender gap in corporate America is still prevalent, especially in leadership roles. In 2021, only 8.2% of Fortune 500 CEOs were female. |

|

|

This graphic shows a timeline of when 15 different animals became domesticated, based on archaeological findings. |

|

|

The mainstream shaving industry no longer fits the needs of modern society. This graphic shows why it's time to rethink shaving. |

|

|

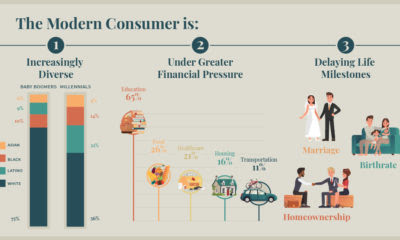

We all have a stereotypical image of the average consumer - but is it an accurate one? Meet the modern consumer, and what it means for business.

Originally from June 2019 |

|

|

| Google Says It Will Pause Hiring | | By Erin Woo | Source: The Information | Google said it will pause hiring for two weeks, after saying last week it would slow its pace of hiring for the rest of the year. In an email to employees viewed by The Information, Prabhakar Raghavan, a senior vice president at Google, said the hiring pause would not impact offers that had already been extended to applicants, but that Google would not make any new offers until the pause was over. “We’ll use this time to review our headcount needs and align on a new set of prioritized Staffing Requests for the next three months,” Raghavan said. Google’s hiring pause strikes a cautionary note ahead of the company’s second quarter earning call, which is scheduled for next Monday. Across the industry, tech giants including Meta are pausing hiring, and startups continue to lay off employees en masse. Earlier this year, Coinbase, the cryptocurrency exchange platform, announced a two week hiring freeze before ultimately laying off 18% of its staff amid the broader crypto crash. | |

|

| | Tesla’s Musk Keeps Car-Growth Goal of 50% Despite Revenue Deceleration | | By Amir Efrati | Source: The Information | Tesla’s financial performance has been the same story for a while: The electric carmaker has generated plenty of cash and has been doing much better than its rivals in terms of revenue growth—42% in the second quarter, to $16.9 billion—and gross profit margin from car sales, which clocked in at 28% in the same period. But those results also showed how macroeconomic factors are crimping growth and margins in the sector: Tesla generated $621 million in free cash flow, but that was flat from a year earlier. And Tesla’s growth rate in the second quarter was half the growth rate during the first quarter. As a result, Tesla’s $770 billion market capitalization still seems out of whack with historical norms of how investors value public stocks based on discounted future cash flows. And that’s even after their price fell 30% so far this year. Rivals including GM, Ford and Stellantis report earnings next week. As Tesla had correctly warned investors three months ago, results in the second quarter were hurt by Covid-19 lockdowns in Shanghai, where it has a key manufacturing facility, and by rising costs for raw materials for batteries and other components. However, the company didn’t cut its plan to increase car production by 50% overall this year, to 1.5 million vehicles (or nearly 1 million in the back half of this year), and CEO Elon Musk said commodity prices were falling. “We have potential for a record-breaking second half of the year,” he said. As for the long-awaited Cybertruck, Musk said it was on track to debut in the middle of next year. | |

|

| | China Slaps Didi With Nearly $1.2 Billion Fine as Yearlong Probe Ends | | By Juro Osawa | Source: The Information | China’s internet regulator said it has slapped ride-hailing giant Didi Global with a fine of about 8 billion yuan ($1.18 billion), concluding a yearlong cybersecurity investigation into the company. The end of the Didi probe could spur hopes among Chinese tech executives and investors that the worst may be over in Beijing’s sweeping regulatory crackdown on the internet sector. The Cyberspace Administration of China also fined Didi CEO Cheng Wei and President Jean Liu 1 million yuan each. Last summer, the internet regulator launched the investigation into Didi and forced the company to suspend new user registrations, while also removing its app from Chinese app stores. The harsh crackdown came after Didi went public in the U.S. against the wishes of the Chinese internet regulator. Didi last month delisted from the New York Stock Exchange. | |

|

| | ByteDance Secondary Shares Trade Below $300 Billion in Private Deals | By Shai Oster | Source: Bloomberg  | Shares in privately held ByteDance traded at a valuation of $275 billion in the secondary market, well below previous levels for the owner of TikTok even as some investors are optimistic about the prospects of an IPO. That figure was far lower than the $460 billion blended valuation that Tiger Global offered when it acquired additional shares, Bloomberg said. The drop in value comes as China’s economy continues to suffer fallout from the country’s strict Covid Zero policy while a global recession hits exports and curtailed spending on online advertising, the main source of ByteDance revenue. Despite that, some investors are growing optimistic about the prospects of a ByteDance IPO. | |

|

| | Microsoft, Oracle Build Data Path Between Their Clouds | By Kevin McLaughlin | Source: The Information  | Microsoft and Oracle, after announcing a partnership three years ago focused on integrating their respective cloud services, are now getting cozier. The companies are jointly launching a new service that lets customers of Microsoft Azure build applications that connect to databases running on Oracle’s cloud infrastructure. What’s even more notable about this collaboration between longtime software industry rivals is that customers won’t have to pay for the networking bandwidth—also known as egress charges—needed to shuttle data in between Microsoft and Oracle’s cloud servers. That could put pressure on Amazon Web Services, which has faced criticism for the bandwidth fees it levies on customers when moving data out of its cloud. On another level, this is a notable illustration of the industry term known as “multi-cloud,” which refers to companies using services from more than one provider. While Microsoft and Oracle are database competitors, their tie-up could lead to more business for both because customers will now have the choice of using whichever database best fits the needs of their apps. | |

|

| | Esports Heavyweight FaZe Clan Goes Public in $725 Million SPAC Deal | | By Maria Heeter | Source: The Information | FaZe Clan, the esports and gaming brand, began trading on the Nasdaq exchange Wednesday after a $725 million special purpose acquisition company merger, in a wager on creators as other SPAC deals fall through and the market for initial public offerings stays largely shut. One of the biggest gaming companies worldwide, FaZe Clan announced its plans to go public with a B. Riley-backed SPAC last fall at a $1 billion valuation. Since then, the esport specialist hired a new president and revamped its board with media power players, like the chief brand officer of World Wrestling Entertainment Stephanie McMahon and rapper and entertainer Snoop Dogg. The new deal valued the combined company at $725 million, a $275 million decrease from their previously expected valuation. SPAC deals have been put on ice as investors pull their money from SPACs at all-time highs. In June, the online brokerage eToro called off its plan to go public by merging with a Betsy Cohen-backed SPAC, The Information first reported. That decision followed similar withdrawals from media company Forbes and ticket platform SeatGeek. Some SPAC managers are giving up on finding target companies before their deadlines arrive, like billionaire Bill Ackman, who returned $4 billion to investors. Shares of FaZe Clan, trading under the ticket “FAZE”, fell at the market’s open. They traded at $9.10 per share as of 12:30 p.m. Wednesday, and rose to $9.85 as of 3:30 p.m. |

|

|

|

:quality(70)/cloudfront-us-east-1.images.arcpublishing.com/tronc/O2RIQ4NC3JCC5N4Z6EHYDFGMLY.jpg)