The SLS exploration rocket is a critical element of the Artemis missions – NASA’s long-term plan to bring the United States back to the moon and eventually to Mars.

From the Earth to the Moon and beyond, SLS is the vehicle that will take human spaceflight into the next generation of deep space exploration. Set aside your disdain for Mark Zuckerberg and his digital Frankensteins for a moment, and consider this question: could the so-called metaverse someday make our dysfunctional online ecosystem better?The Facebook co-founder and Meta CEO, in a rare extended interview aired Thursday with podcaster Joe Rogan, actually made a compelling—if gravely naive—case for the merits of the metaverse. In Zuckerberg’s vision, this still-nebulous mix of augmented and virtual reality will help create more intimate social experiences, bringing people together (albeit in avatar form) in settings more conducive to friendlier relationships. Rather than passively sniping at each other from the comfort of a keyboard, Zuckerberg foresees a return to more active interactions in his company’s nascent creation. “I think it’s probably going to be a lot healthier for us,” Zuckerberg told Rogan. “Rather than consuming all this additional context through this tiny little portal we carry around on a phone … I think to have it be able to be overlaid and have kind of people be able to pop in and interact through it, I think that’s going to be powerful.”Zuckerberg went on: “My goal for these next set of platforms, they are going to be more immersive, and hopefully they’ll be more useful—but I don’t necessarily want people to spend more time with computers. I just want the time that people spend with screens to be better. Today, so much of it is you’re just sitting around in this beta state, consuming stuff.” In some sense, Zuckerberg’s intuition feels refreshing. Our current suite of technological devices has simultaneously made us more digitally connected but physically isolated. A new ecosystem that makes it easier to see and hear each other in a meaningful way should, in theory, help mend our fraying social fabric.Yet Zuckerberg himself, along with fellow tech pioneer Jack Dorsey, showed us Thursday why this utopian vision is more dream than destiny.Despite their initial noble intentions for Facebook and Twitter—namely, providing platforms for making the world more connected—both platforms have evolved into uncontrollable monstrosities, causing damage that their founders never foresaw. For perspective on the scope of those issues, consider how Zuckerberg told Rogan that Meta, the parent company of Facebook and Instagram, now spends somewhere in the neighborhood of $5 billion per year on its “community integrity” teams. Those units are responsible for identifying abusive content, removing harmful material, and combating disinformation, among other tasks.The breadth of Meta’s safety, security, and corporate issues are so vast that Zuckerberg admitted he wakes up most mornings and feels like he’s been “punched in the stomach” after looking at the deluge of “not good” messages on his phone. Think that’s what Zuckerberg envisioned in his Harvard dorm room?Dorsey was less elaborate Thursday in his thoughts on Twitter’s state of being, though no less rueful about his creation. Asked by an apparently random Twitter user whether the platform “has turned out the way you wanted,” Dorsey replied: “The biggest issue and my biggest regret is that it became a company.” He went on to state that he wished Twitter had become “a protocol,” commonly defined as decentralized, interoperable tools used to power ubiquitous digital programs, like email and instant messaging. The comment echoed past gripes by Dorsey about Twitter becoming “owned by Wall Street and the ad model.” While Dorsey hasn’t gone into great detail about these complaints, the obvious implication is that financial motives have overtaken the platform, leading to the amplification of popular-but-divisive content and the unnecessary censorship of speech. In many ways, Zuckerberg finds himself back at the early days of Facebook, trying to create something from scratch (albeit with billions of dollars and thousands of employees at his disposal this time). “I just want to make it so that the experiences we’re having aren’t just these passive things,” Zuckerberg told Rogan.Yet the metaverse is already rife with questions about troubling user behavior, ranging from harassment to hate speech to virtual violence. It’s also easy to envision a plethora of impending ethical dilemmas about what kind of interactions will be allowable, how behavior will be policed, and how Meta’s monetary motives will influence its decision-making.Zuckerberg might “just want to make” things, but he should know by now it’s never that simple.

| | ◯ Conflict ◯ Development ◯ Social ◯ Economics ◯ Politics

|

|

|

|

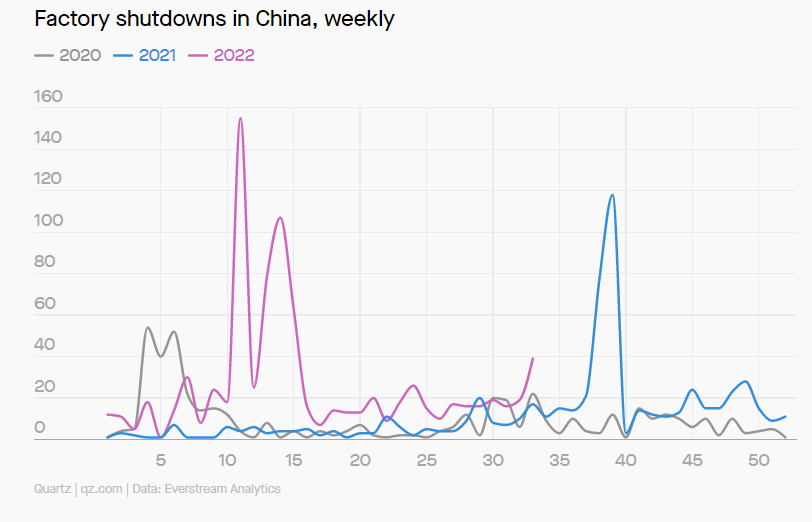

IN THIS WEEK'S EDITION Here's what you need to know: Ukraine agrees to UN nuclear plant mission at tripartite meeting, El Salvador extends state of exception; 50,000 arrested, Myanmar generals move to cement power in attempt to weaken resistance, US pharmacy chains ordered to pay over $650 million in opioid case, the drought is causing China to shut down its factories to save power, hotter summers mean almost all Florida turtles are born female.  Tweet this email Tweet this email

View this email on the web View this email on the web

|

|

|

|

SPECIAL EDITION: UKRAINE Ukraine agrees to UN nuclear plant mission at tripartite meeting. The Ukrainian President has agreed to the parameters of a potential mission of the International Atomic Energy Agency to the Zaporizhzhia nuclear plant, after repeated shelling of the complex raised fears of a nuclear catastrophe. China to send troops to Russia for 'Vostok' exercise. Chinese troops will travel to Russia to take part in joint military exercises led by the host and including India, Belarus, Mongolia, Tajikistan and other countries. Russia points finger at Ukraine in killing of Darya Dugina. Russian intelligence accused Ukrainian special services of carrying out a car bombing that killed Darya Dugina, the daughter of an influential Russian ultra-nationalist who has backed Moscow’s invasion.

|

|

|

|

POLITICS El Salvador extends state of exception; 50,000 arrested. 50,000 people have been locked up since late March for alleged gang ties. Congress has approved another month-long extension of the state of exception that suspends fundamental rights in the name of combatting the country’s powerful gangs. Israel and Turkey to reinstate ambassadors after 4 years. In 2018 diplomatic relations were terminated following the killing of 60 Palestinians by Israeli defence forces. This development will strengthen economic, trade and cultural ties. India to register up to 2.5 million voters in contested Kashmir. India is expected to register as many as 2.5 million new voters in the contested Jammu and Kashmir region. Local political parties said it was an attempt to influence upcoming elections. Police file terrorism charges against Pakistan’s Imran Khan. The terrorism charges follow a speech Khan gave in Islamabad on Saturday, in which he vowed to sue police officers and a judge. He also alleged that a close aide had been tortured after his arrest. Mexico arrests former top prosecutor in 2014 missing students case. Mexican officials made the first high-level arrest in the notorious 2014 disappearance of 43 students, accusing a former top prosecutor of crimes in one of Mexico's worst human rights abuses. UAE ambassador to Iran to return, 6 years after relations severed.

The Emirati and Iranian foreign ministers discussed boosting ties, including sending an ambassador back to Tehran. |

|

|

|

CONFLICT Myanmar generals move to cement power in attempt to weaken resistance. Coup leader and military government chief Min Aung Hlaing has fired military chiefs and senior politicians to suppress opposition. This comes after six years was recently added to the prison sentence of deposed leader Aung San Suu Kyi. Kenya’s opposition leader rejects the presidential election result as 'null and void'. Protests began even though Raila Odinga urged his supporters to remain peaceful. Demonstrators battled police and burned tyres in the western city of Kisumu, and the capital Nairobi's huge Kibera slum.

US: Spike in weapons smuggled to Haiti and the Caribbean. US authorities have seen a spike in weapons smuggled to Haiti and the Caribbean in recent months. They have promised to boost efforts to combat the trade that is fuelling rampant gang violence in the region. NATO will step up forces if Serbia-Kosovo tensions escalate. NATO will increase its peacekeeping force in Kosovo if there is an escalation of tensions with Serbia, on the eve of EU-facilitated talks between the estranged western Balkan neighbours. Multiple bomb, arson attacks rock Thailand’s south. Explosions and fires ripped through at least 17 locations in southern Thailand, in what appeared to be multiple coordinated attacks. The restive region has seen more than 7,300 people killed since 2004.

|

|

|

|

ECONOMICS US pharmacy chains ordered to pay over $650 million in opioid case. Three US pharmacy giants were ordered to pay over $650 million to two Ohio counties, in compensation for their role in the opioid epidemic. Bangladesh raises fuel price by 50% in one week. Bangladesh has blamed rising oil prices on the war in Ukraine. Thousands of people have taken to the streets in protest, as another South Asian nation faces a growing financial crisis. Cuba to allow foreign investment in wholesale and retail trade. The Cuban government will allow foreign investment in domestic wholesale and retail trade for the first time since 1959. The move aims to address critical commodity shortages and boost local industry. German dependence on China growing "at tremendous pace". China's share of German imports rose to 12.4% in the first half of 2022, compared with 3.4% in 2000. The trade deficit leapt to 41 billion euros. China declares first ever drought emergency amid intense heatwave. China has declared the drought emergency amid fears that a period of exceptionally hot and dry weather will lead to significant shortages of water. The drought has wilted crops and left reservoirs at half of their normal water level.

|

|

|

|

SOCIAL Battle for trademarks as brands leave Russia. Following the invasion of Ukraine, many Western brands ceased their activities in Russia but their products or brand names can still be found on the market due to parallel imports and reappropriation of brand identity. Hotter summers mean almost all Florida turtles are born female.

Florida’s sea turtles have a worsening gender imbalance due to climate change. Recent heat waves have caused the sand to be so hot that nearly every turtle hatched was female. Chinese internet giants give algorithm data to government. Chinese internet giants including Alibaba, Tiktok-owner ByteDance and Tencent have shared details of their algorithms with China's regulators for the first time. Female Saudi activist gets record 34 years in prison for critical tweets. Saudi Arabia sentenced the woman to 34 years in prison over her Twitter activity, marking its longest sentence ever for a peaceful activist and launching a fresh wave of fear among the government’s detractors. Pandora announces extended use of lab-made diamonds. The world’s largest jewellery maker is moving ahead with lab-made diamonds, which are more sustainable due to lower carbon emissions.

|

|

|

|

DEVELOPMENT Intergovernmental Conference to draft first ever treaty on ocean biodiversity.The treaty addresses conservation and sustainable use of marine biodiversity in the world’s oceans. Negotiations will address marine genetic resources, environmental impact assessments, capacity-building and the transfer of marine technology. Nearly half the people in Ethiopia's Tigray in severe need of food aid. The nearly two-year conflict in Ethiopia has left almost half the population of the Tigray region in severe need of food, as aid groups struggle to reach the population because of insufficient fuel supplies. Malawi and Zambia engage in talks to strengthen bilateral relations. The country’s heads of state met at the 42nd Ordinary Summit of SADC and discussed issues of mutual interest designed to enhance trade. World Bank deploys $20.7 billion in post-pandemic support, Latin America and the Caribbean Region. As the regions continue to deal with the negative impact of the pandemic, the World Bank has deployed $20.7 billion in support. This brings total support to Latin America and the Caribbean to $50 billion since 2020.

CHART: The drought is causing China to shut down its factories to save power. |

|

|

|

| In last week's Future Trends, Argentina's central bank raised the key interest rate by? | | | | |

|

|

|

|

|

|

| FREE DOWNLOAD | | | Ecological Threat Report 2021 | |  | | Get the data behind the global threats amplified by climate change, from food and water risk to rapid population growth and natural disasters.

| |

|

|

|

|

No comments:

Post a Comment